This past week we have seen some positive price action take the market by force, driving the S&P 500 back above break-even for the year (Figure 1). The broader equity market posted a strong rally on Wednesday following two words (yes… two words) spoken by Jerome Powell, head of the Federal Reserve, “just below”. This implied that the previously hawkish stance of the Fed was being toned down somewhat and many have been calling it a little hawkish and little dovish. What the Feds will do – well, only time will tell.

Generally, equity markets prefer lower interest rates since it spurs growth in corporations and the overall economy. However, if rates are left too low for too long, inflation can run rampant and the economy can head south very quickly. This puts enormous responsibility on the Federal Reserve for monitoring the financial stability of the US economy. Mr. Powell had quite some positive words to share about the current state of our economy on Wednesday, while simultaneously acknowledging the difficulties it could face. This said, the likelihood the Federal Reserve will raise interest rates at their December 18/19 meeting is nearly 100% and fully priced in the market already. So why did we see a 2.3% rally in the S&P posted Wednesday? Traders and investors were speculating that given his comments the rate hikes in 2019/20 could be reduced, posing a long-term bullish case.

Now be careful with this bullish information. The market has so much headline risk right now it’s almost palpable. Algo’s and trading bots scraping any headline are causing temporary gyrations across all markets the moment anything about this weekend is mentioned. In my last email, I mentioned the Trump/Xi meeting at the G-20 summit this weekend. They are slated to have a meeting on Saturday and Trump has been throwing out positive-seeming one-liners regarding the upcoming meeting, along with positive comments from his closest advisors who are attending the meeting. However, you cannot forget that both leaders are playing charades and a poker game at the same time.

The importance the GLOBAL MARKET is placing on this meeting is substantial. I have yet to find a consensus agreement on what will occur at this meeting, but everyone is looking, waiting, and watching. Whether this meeting will be of substantial value, we will find out this weekend and in the ensuing days/weeks, but the chatter and price action seen this past week points towards the potential importance of this meeting. Hence the headline risk.

Before we dive further into this, let’s examine from an eagle’s eye what’s at stake:

- US raising tariff’s on $200B of Chinese goods from 10% to 25% on 1/1/2019

- US placing another round of tariffs on $267B of Chinese goods (effectively tariffing the US’ entire import value from China)

- Chinese conciliation on certain demands the administration has placed on them

- Protection of US technology in China through acknowledgement of IP

- Avoid a cold war and help spur both countries’ economies

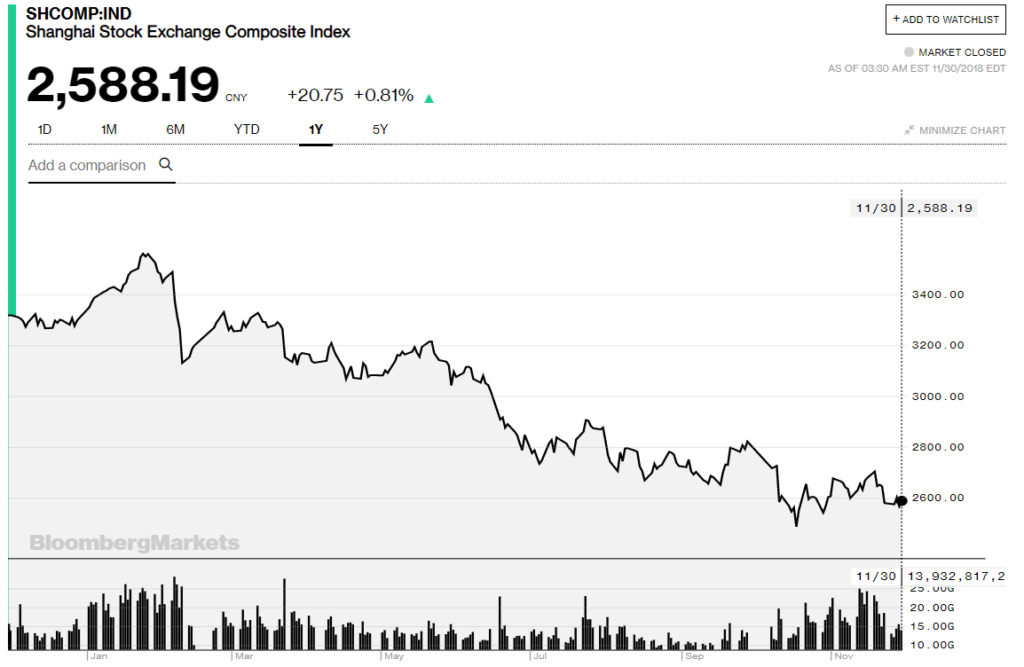

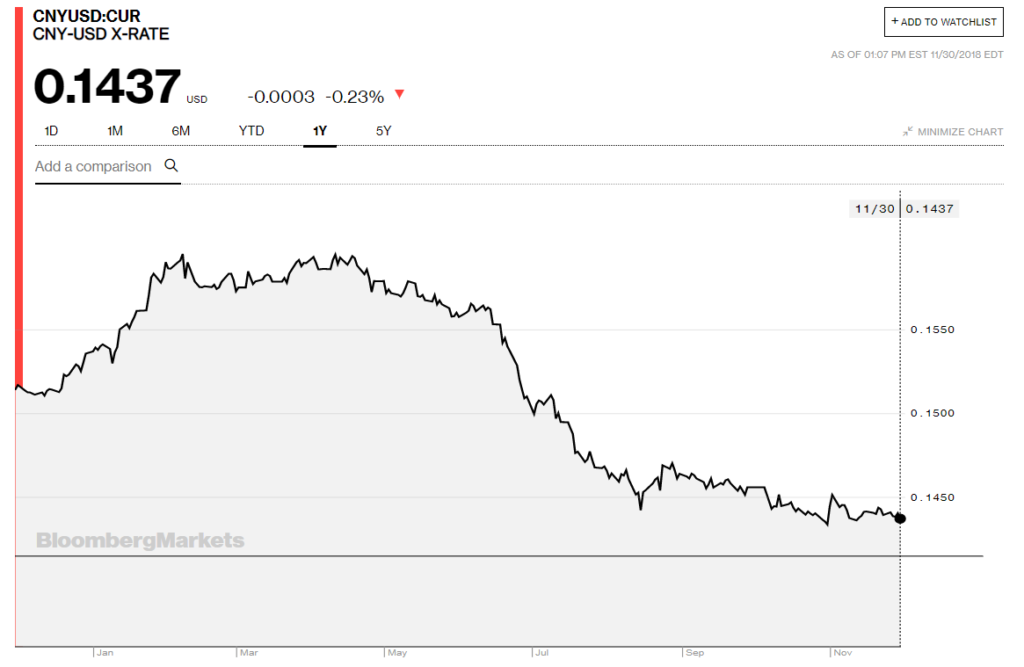

If the two leaders cannot have a positive conversation on Saturday, there is a large chance the tariff increase will occur on 1/1 and the remaining tariffs will be put into place. I do not need to tell you what this means for US businesses or our economy as you have seen the result this past year. I anticipate quite negative price action if this occurs, even with the bullish remarks out of Powell. However, there is conjecture that the meeting will be quite positive in which a glimmer of bullish news or hope could be produced. Pancake this on top of the recent comments by Powell and the S&P certainly has the capability of posting a strong rally and closing the year strong (but beware – see below). The chance of news leaning towards the positive, in our opinion at DAM, is stronger than the negative. Simply look at the state of the Chinese economy. One look at the Shanghai Composite and the Yuan vs USD this year could make your stomach churn (Figures 2 and 3). Suddenly the gyrations experienced in the US equity markets this past 12 months don’t seem quite as significant.

When the market places massive amounts of significance on a single event, it is somewhat difficult to turn a shy eye. While nothing tangible (signed agreements, etc.) will come out of this meeting, even the hope of the end of the trade war can spur substantial price movements. For the time being we are still advising a sideline/neutral position since there is risk in either direction. Additionally, just because positive news could be produced from this weekend, does not eliminate the geopolitical risk and global market headwinds. The economy is fragile when it’s posting record numbers and only time will shed light on whether it can be maintained.

“The four most dangerous words in investing are: This time it’s different.” – John Templeton