Today the S&P 500 closed down 45 points or -1.56% after a rather wild day with many interspersed attempts at getting back to unchanged. The last two weeks have been incredibly pivotal in markets since a bout of bad manufacturing data caused the market to sell off last week (where bad data is actually interpreted negatively), followed by a technical bounce, and a lackluster jobs report which sent stocks soaring — again more a technical short-term move than fundamentally driven.

Today, Fed chairman Powell announced what is bordering on Quantitative Easing — where the Federal Reserve purchases US Treasury bills in the marketplace. In the past, equity markets have gobbled up news like that, so what changed? Can it really be all the less and less meaningful headlines about China? You are all too aware of our opinion on that.

We think the last week of market trading on the multiple events (including today) will prove to be absolutely pivotal. This last week has reversed a significant trend all year where stocks would rally on bad news since it implied more rate cuts from the Fed. Well, we got the “insurance” rate cuts, and even some treasury purchases, and yet the US economy is in worse shape than it was before all of this began. What gives? Is the plausible recession actually a risk to the US stock market now? There’s no way to tell definitively, but we think the next 3 months will be the sign.

These next 3 months will determine the next 5 years. If the equity market holds steady or rallies over the next 3 months, at DAM, we believe it more likely that a recession can be avoided — stocks are the backbone of consumer confidence currently which tends to drive business investment decisions (in the grand scheme of things), which drives overall GDP growth. However, if US equities fail to find buyers over the next 3 months (which is a large risk), a significant decline could unfold, which would, for DAM, absolutely solidify the plausible recession. The large retirement account exposure to US equities and confidence tied to the market could quickly cause consumers to tighten their wallets, along with the sluggish growth we tend to experience in the winter months.

Why 5 years? We believe that if a recession occurs before the next election, that could drastically impact the outcome. Trump has been playing hot potato with Powell all year on who is holding the bag if the US falls into recession. What will the media and the constituents believe? Considering the majority of Americans know who Trump is, and a minority know who Powell is, our inclination is that “Trumps Trade War” will take the crown as the new “Mortgage Crisis” (we have expressed our opinion on this many times and do not need to dive into these assumptions).

Given that, we still maintain our sell recommendation for US equities, but cannot recommend other havens for returns in the interim given the movement in US bond markets. If you are holding a long bond position, continue to, but we believe cash will be an out-performer of US equities going into the end of the year (and since our recommendation in March). We believe significant opportunities will present themselves to the cash holder later down the line.

Given recent questions too, we would like to mention what would allow us to shift our “sell” recommendation on US equities to a “buy” (markets change constantly and things can shift quickly, so we are never blind to what could shift our sentiment). There are a few absolutely critical criteria that we believe would allow the absurd equity valuations to extend further (a 1998 or 2016 scenario). They are as follows:

1). A notable weakening and broken uptrend in the USD relative to other currencies

2). A notable weakening and broken uptrend in the USDCNH (notably below 7.0)

3). A VIX which persists below 13 for 3 months or more

4). A notable bottoming in US economic indicators (reversal in the downtrend instead of occasional “green shoots”). Please note, bottoming does not necessarily mean improving, just not getting worse.

5). A stagnant or rallying US government duration yield (the 10yr persists above 2.0 but below 3.0)

Given these criteria, if we see them come to fruition, it would allow us to confidently declare US equities a buy given the scenarios that have played out in the past and how bullish these indicators tend to be for US stocks. If 3/5 are met, we will begin to analyze other portions of the market to help deepen the assessment.

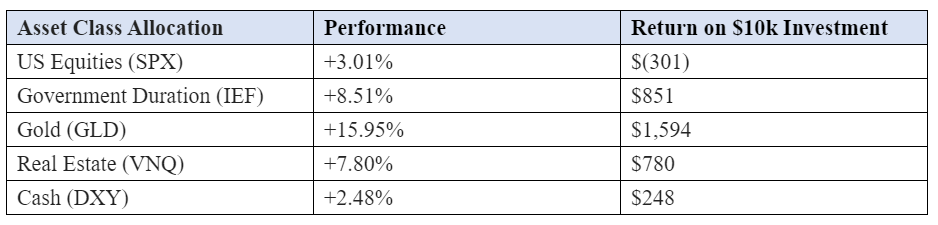

Here is an update on how the trade we recommended in March has performed; we apologize for all the blabber and not as many charts as usual.

So with that, happy voting the next 3 months? Good luck out there.