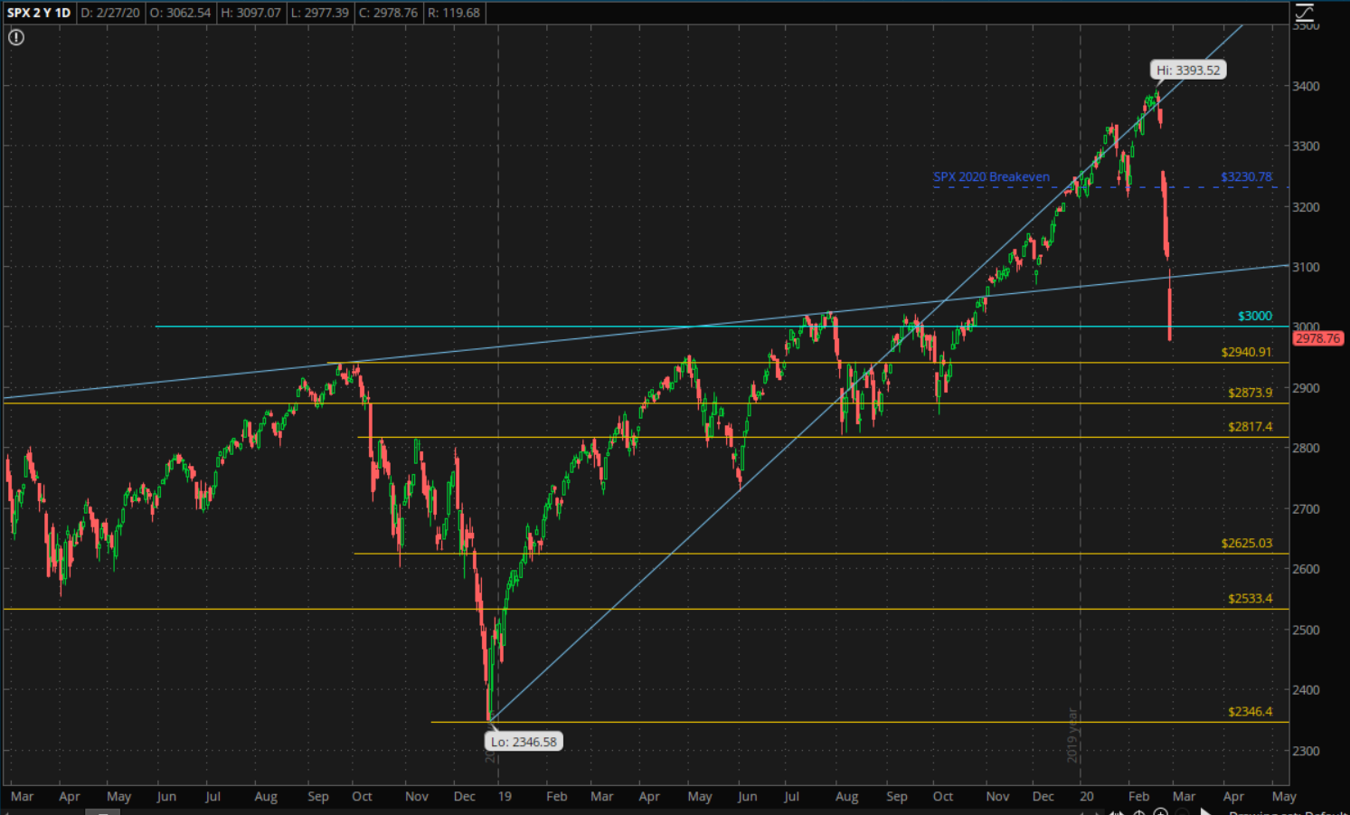

It’s difficult to come up with something to say, other than “wow”. The S&P closed down 135 points or -4.4% for the largest point decline in history (Figure 1). First and foremost our timing of “neutral” stance could not have been worse (it happens). So take the “do as we allocate, not as we say approach” since we have weathered the market’s recent slide very well. In fact, our YTD returns are +1.75% and since the beginning of FY19 are +18.1%. In regards to this market’s move, we have believed that sentiment was very much skewed to the upside still considering we were being blasted with notifications about buying every dip throughout this week. To be frank, we’ve expected a bounce since Tuesday’s close which has yet to materialize. Every intra-day bounce continues to get Whac-A-Moled back to down -2% or more. Is this the start of the bear market we’ve been warning of? There’s no way to tell. The challenge comes in navigating these broad liquidations since it seems like nothing can go up. Do you jump ship? Do you buy the dip? Do you just hang on and hope for better days ahead?

We tend to have a strong opinion one direction or another, and in this case it’s difficult for us to formulate one. We have been pointing out vulnerabilities in this market for over 18 months and really all it takes is a single unpredictable catalyst (Coronavirus) to cause a broad unwind in risk assets to shed an unwanted light on the vulnerabilities. We believe we have witnessed that this week. All we can generally say is play it safe and think, really take the time to think before you do anything in terms of allocations in this market.

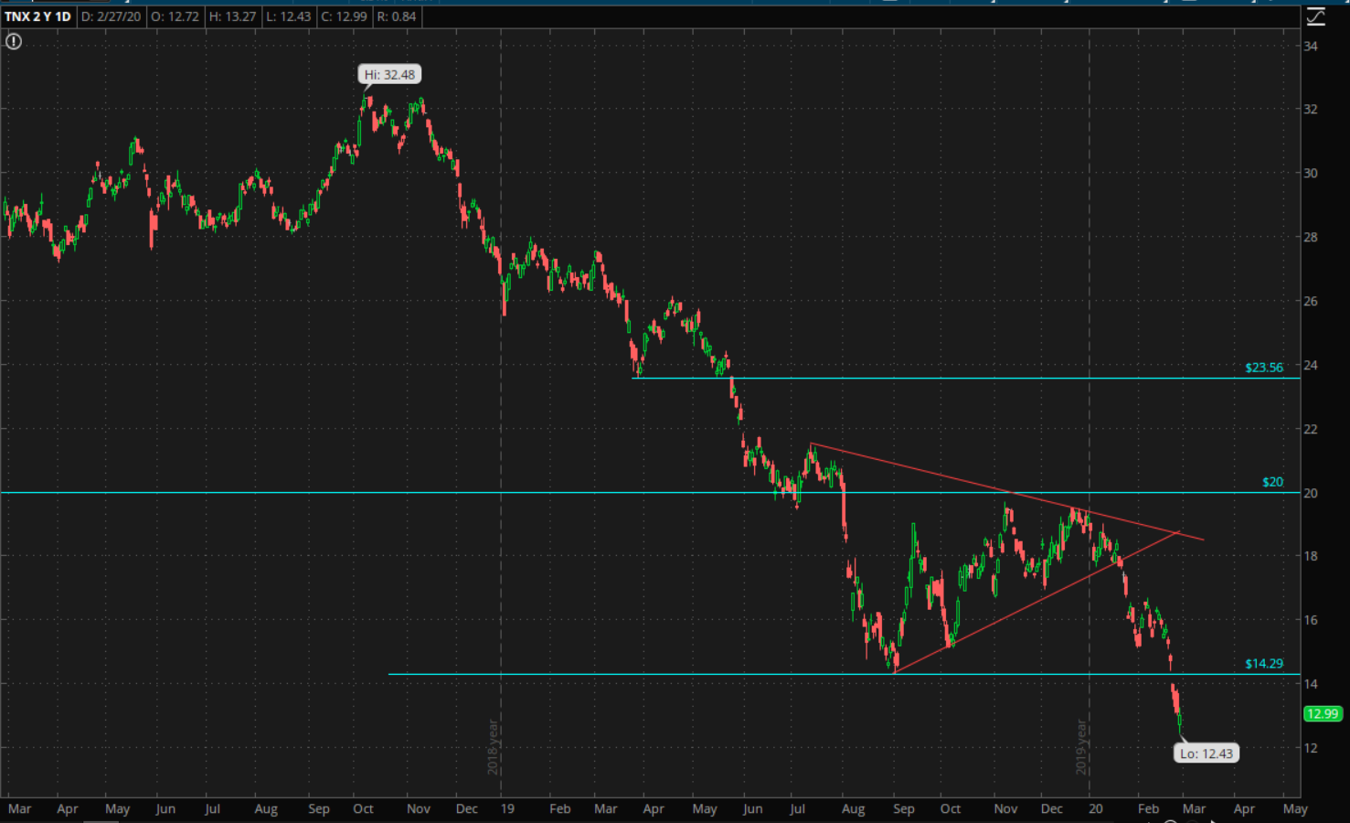

For our investments, we were diversifying our long bond strategy with a hedge; this gave us long commodity exposure. Unfortunately, this hedge has worked poorly and has eaten into the gains we would have experienced from the recent bond rally this week. That said, the risk/return from bonds is currently waning with the 10yr yield trading at all time lows of ~1.3% (Figure 2). The rally on IEF (the ETF with long duration government bond exposure) from March when we laid out our “bonds will outperform” case has been 10.5%. The 10yr was trading at 2.6% at the time. This implies that there is realistically only 10% of future returns left on the table implying that the 10 yr yield will trade at 0%. DO NOT doubt that this could happen. Last March when we chucked our equity position out the window, we projected the 10 yr yield would hit 0% before the election. While we still believe this is likely, we have to be strategic in our approach to getting there. The slide in yields and equities has caused us to reduce our exposure to bonds and continue to allocate capital to cash and physical gold. We will also be reducing our commodity hedge exposure since we are reducing our bond exposure.

Listen, the Coronavirus was completely unpredictable. This market appears to be pricing in the fact that if this thing hits the US it paints a beautiful red carpet for Bernie Sanders to waltz into the White House on. Regardless of your political opinion, this is JUST ABOUT THE WORST CASE SCENARIO FOR EQUITY MARKETS. Sanders has openly bad-mouthed the finance industry and has made it abundantly clear he does not give a rats ass about the stock market. The combination of record valuations, incredible leverage, generally poor liquidity, and a potential economic shock has caused a steep decline in the US stock market. The challenge is “when will this stop?” February is rounding out and we have had 4 straight days of “wicked” declines. These sell-offs tend to culminate on themselves and have a way of becoming very scary, very quickly (reference Dec 2018).

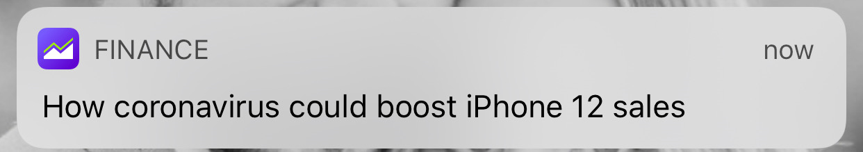

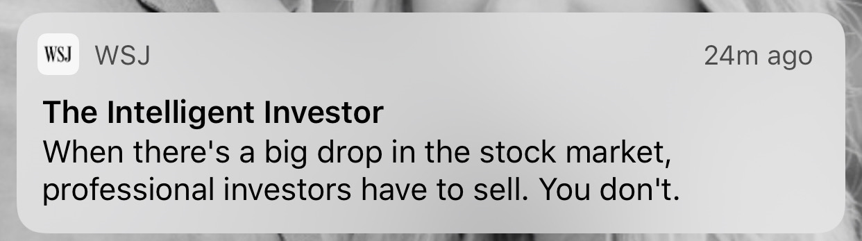

Overall, our inclination is that this selloff is not quite done. It’s certainly overdone in the shorter term time horizon, but are retail investors jumping ship yet? There’s a lot of bullishness still out there (SOMEHOW!). You don’t see articles from Yahoo Finance saying “The Coronavirus could boost Apple’s iPhone 12 Sales” (Figure 3) at the bottom of the market. The sentiment pendulum swung, as we had outlined, but did it just get left behind? (Figure 4) Keep your eyes peeled for aggressive bearishness and capitulation from broad retail investors to dumb stocks. Once this occurs, we’ll be looking at starting to dip our toe back into the US equities

Trade safely out there and be strategic in your decision making. Seriously, THINK before you do anything in your portfolio and ask yourself if it aligns with your strategic investment goals. If you have any questions, comments, concerns, or just need someone to talk to about the markets and what the heck is happening, please reach out.