The phrase “house of cards” conjures images of many things (aside from, in the most literal sense, an actual house of cards) including instability, fragility, and a lack of permanency. From a birds-eye view, the US housing market does not immediately conjure these images. Some houses are flying off the market, bidding wars still exist, and you can find plenty of stories about billionaires purchasing waterfront mansions (in cash). However, a deeper dive pulls back the frail veil of strength and reveals a (figurative) house of cards. To be up-front, I do not believe we are approaching another “2008 Housing Market Crash”. Anyone who is projecting such an outcome, in my opinion, has far too draconian of an outlook.

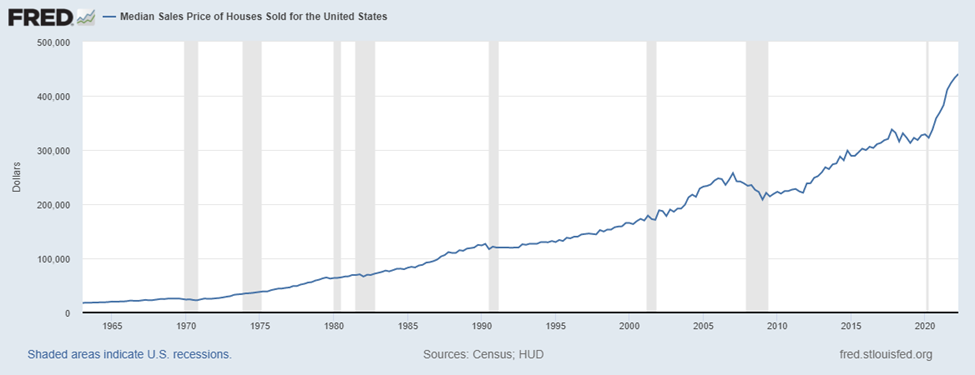

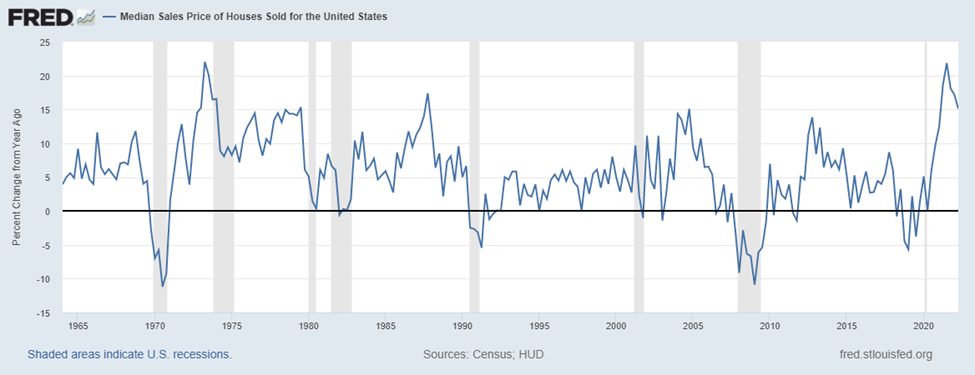

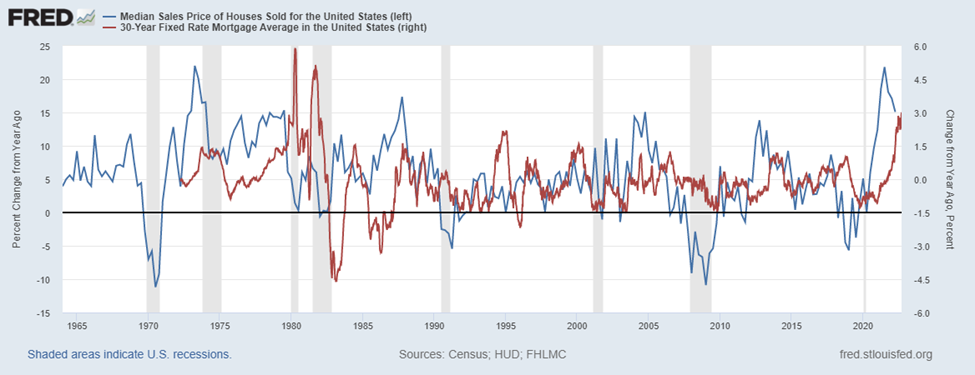

Let’s start with the glaringly obvious, the veil of strength: the median sales price (Figure 1). As many are likely aware, this has exploded higher in the last 30 months. Prices have posted the largest year-over-year (YoY) percent increases since 1974 (!), clocking in at just shy of 22% which is the largest YoY gain in the last 58 years (Figure 2). Homeowners have reaped enormous benefits of owning a home since the bottom of the COVID recession.

Even at a glance, you can see the YoY chart depicts a pattern that cannot be discerned from the general price chart: a top in the velocity of price change. That is, YoY price increases have topped out. This is important, because 8 of the last 9 “top-outs” in price increases preceded a recession and 5 of the 8 recessions resulted in an eventual YoY decrease in house prices. Interesting.

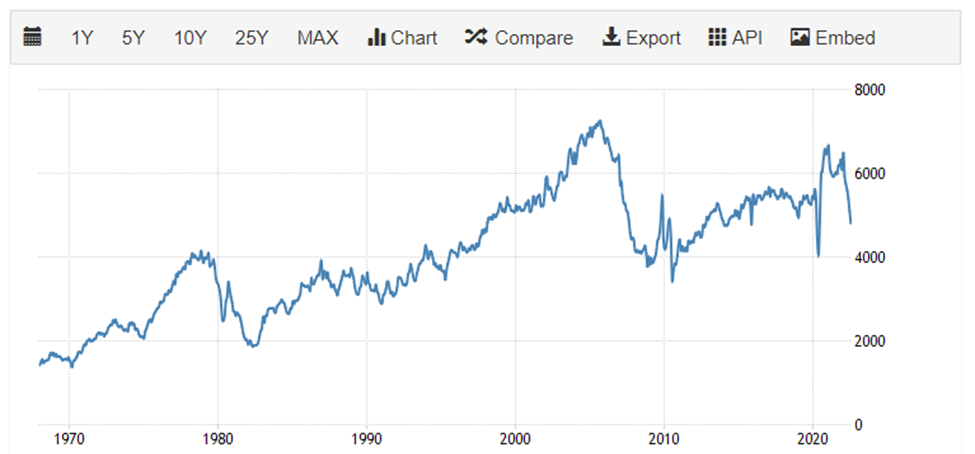

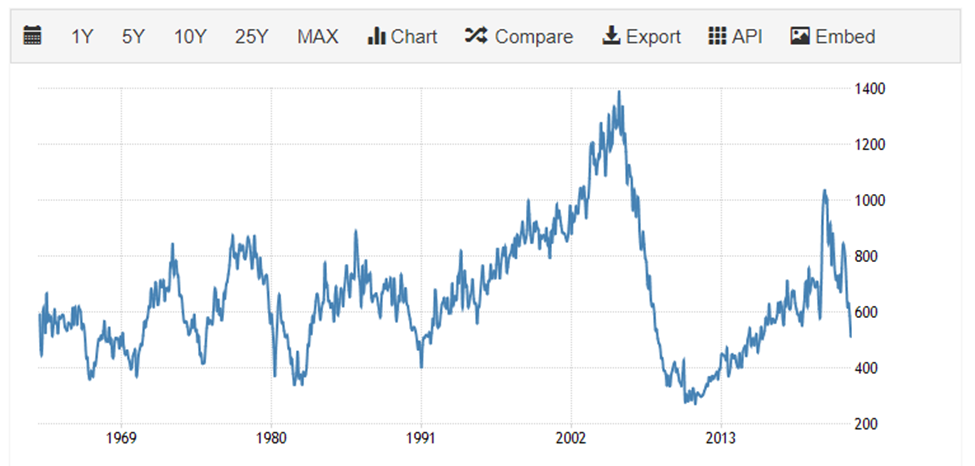

Let’s compare this to existing and new home sales (Figures 3 and 4). Even though we aren’t able to overlay Figures 2 through 4, the correlation is discernable nonetheless. Even a moderate reduction in home sales (whether existing or new homes), invariably leads to an eventual top-out in prices. Further, the persistent and significant decreases in both metrics, especially at the same time has generally been worrisome.

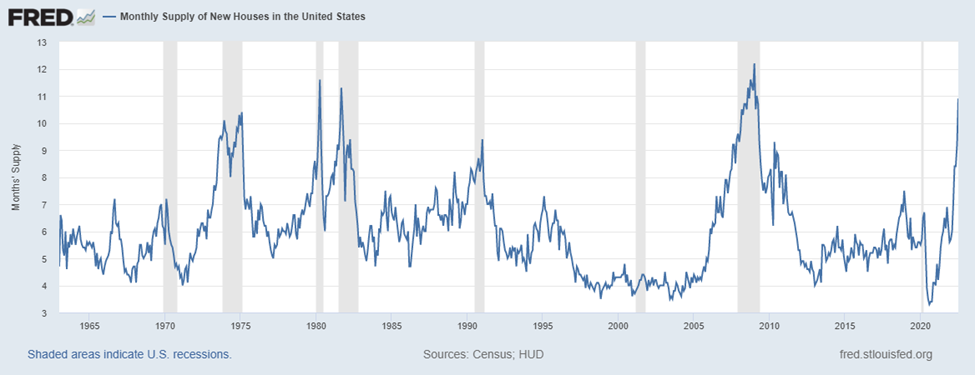

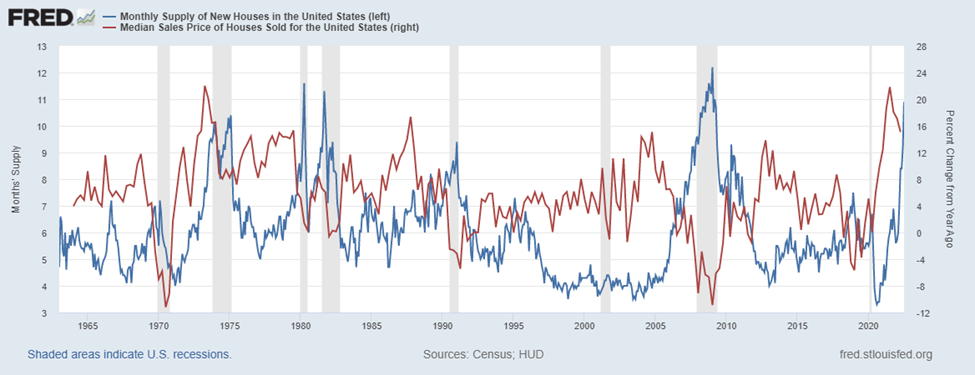

Intuitively, when we have a reduction in broad sales, this results in an increase in housing supply. The past few years has seen a dramatic reduction in supply as observed by the collapse in the wake of the 2020 recession (Figure 5). However, the last few months have presented a dramatic trend change and an explosion of supply. Importantly, every major increase in housing supply has preceded the last 8 recessions since 1969! This completely bucks the current narrative of “there’s no supply”. That said, this supply metric includes new homes which have seen a dramatic increase in supply over the last year with the tapering and/or reduction of input costs such as lumber, copper, labor, etc.

Comparing this to the YoY home price changes (Figure 6) proves to be noisy, but we can discern a notable pattern – in 7 of the 8 recessions, a spike in housing supply led to a collapse of price increases.

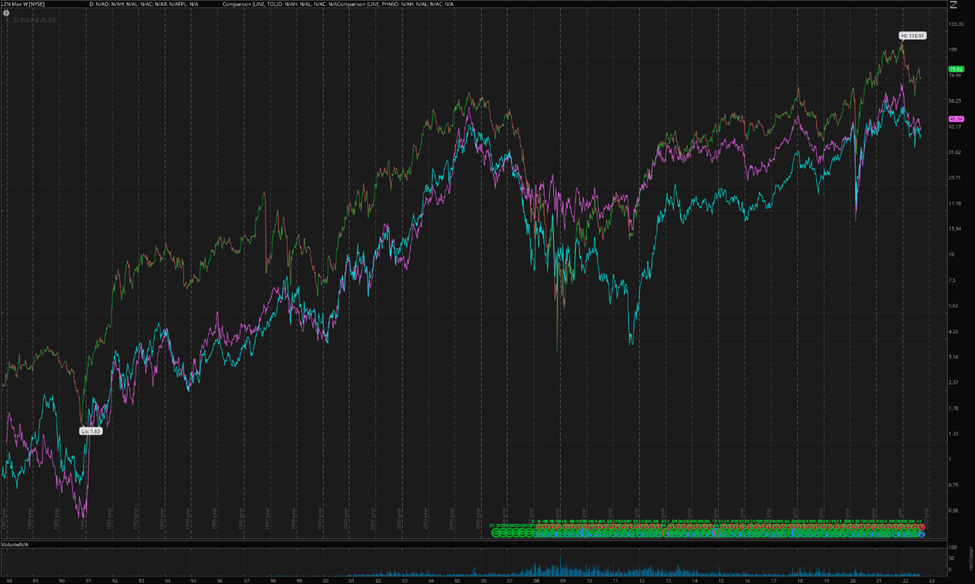

This trend can be further examined in the performance of home builder stocks. Lennar ($LEN – Figure 7) which has seen its stock price already fall over 30% from its highs and was down over 45% as of June, making relative lows since July of 2020.

Examining additional home builders, including Toll Brothers ($TOL) and Pulte ($PHM) on a much longer time frame reveals an obvious trend (Figure 8**). A major collapse in home builder stocks has preceded the last 4 recessions (1990, 2000, 2008, and 2020). Home builders are a critical component of not only the housing market, but the economy as a whole.

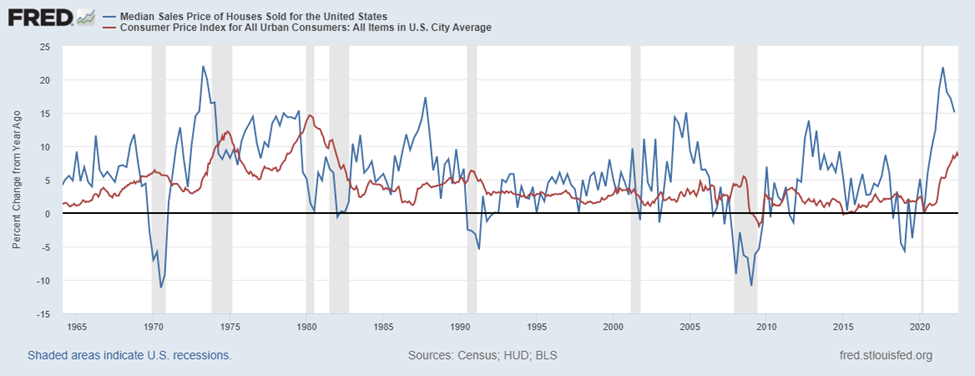

Let’s shift our attention to interest rates and inflation, which are extremely important in today’s economic environment. The correlation between YoY home prices and CPI is noisy (Figure 9), but it is not surprising to see the two move in tandem, especially during periods of higher inflation (1970s).

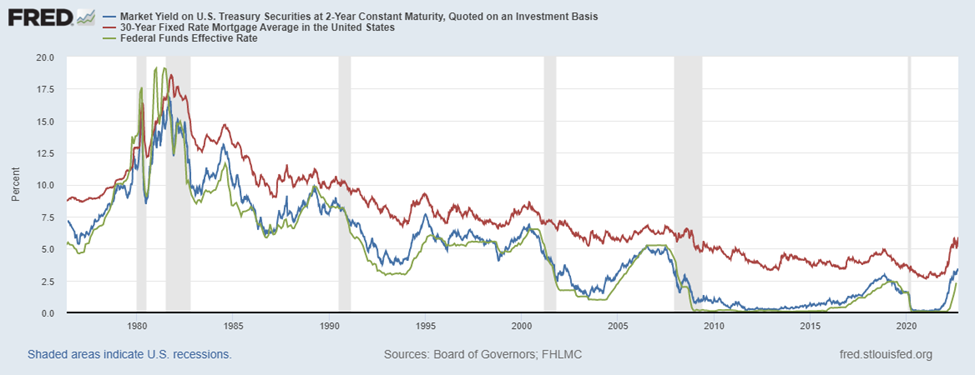

Currently, the Federal Reserve has indicated that inflation is its #1 concern and will not stop until it has been reduced to more accommodative levels. What that “accommodative level” means is up for conjecture, but their intentions are clear – raise interest rates (Figure 10). Generally, the Federal Reserve’s interest rate (EFF) and the 2-year treasury rate track each other perfectly (for all intents and purposes). This is important since the average 30-year mortgage rate broadly follows the same trend, although it is usually at a higher rate.

This makes the intentions of the Fed extremely important since they directly impact current mortgage rates. Let’s compare the change in mortgage rates over a 1-year period compared to YoY home prices (Figure 11). A notable pattern emerges – mortgage rates tend to follow an increase in home prices. Unfortunately, rates continue to persist higher beyond the topping-out of prices, which is undeniably a critical cause of the eventual reduction in home prices.

While there are always pockets of speculative activity in any market, it is abundantly clear that the “house of cards” weakness has sifted its way through the underbelly of the housing market. For the average homeowner, seller, or buyer across the country, conditions have already dramatically changed. Several mainstream media outlets have pointed to an oncoming challenge in the housing market, but the truth is it’s already here and has been here for a few months. Even the Gallup Poll (Figure 12) revealed a material softening in housing market sentiment beginning last year.

It is evident that the US Housing Market as a long-term investment is strategic and successful. However, there are periods of lackluster price growth, including periods of falling prices. While always overcome in the long run, these periods have proven to be very difficult times for homeowners, consumers, and the US economy. Taking pen to paper leads to the conclusion that there is a persistent slow-down in the US housing market that is akin to a recessionary environment. Ultimately, the slow-down in the housing market is already here and has been for some time.

Every slow down, collapse, or a reduction in market activity looks different, but the fact is the US housing market is at a make it-or-break it moment in defining the severity of the existing slowdown. Either activity needs to pick up or prices will inevitably have to fall, just like a house of cards.